A Comprehensive Guide to Payroll Management for Small Businesses

A Comprehensive Guide to Payroll Management for Small Businesses

Payroll management is a crucial aspect of running a successful small business. Ensuring that your employees are paid accurately and on time is essential for maintaining employee satisfaction, productivity, and compliance with labor laws. In this comprehensive guide, we will provide a step-by-step overview of the payroll process, discuss various payroll options, and offer tips on choosing the best payroll service for your small business needs.

1. Understanding the Payroll Process

The payroll process involves multiple steps, each of which must be carried out accurately and efficiently to ensure smooth payroll management. These steps include:

a. Tracking Employee Hours

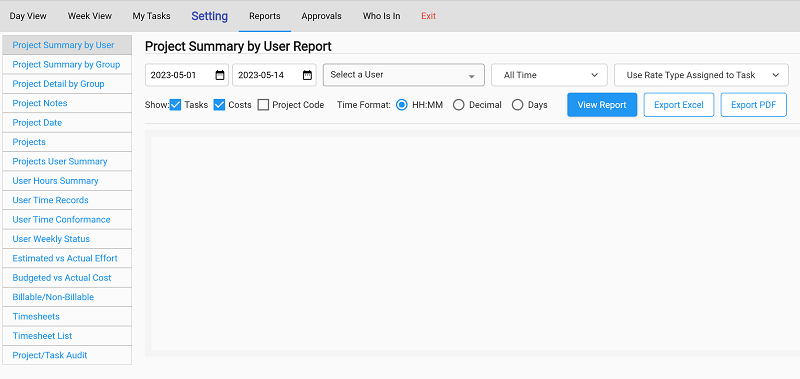

Monitoring the hours worked by each employee is the first step in the payroll process. This can be done using manual timesheets, time clocks, or automated time tracking software. Accurate tracking of hours worked is crucial for calculating wages, overtime pay, and other mandatory deductions.

b. Calculating Wages and Deductions

Once employee hours are recorded, employers must calculate wages based on their pay rate and hours worked. This includes determining regular wages, overtime pay, and any bonuses or commissions that may apply. Employers must also calculate mandatory deductions such as federal and state income taxes, Social Security and Medicare taxes, and any other deductions such as health insurance premiums or retirement contributions.

c. Distributing Employee Pay

After calculating wages and deductions, employers must distribute pay to their employees. This can be done through direct deposit, paper checks, or other payment methods. It's essential to ensure that employees are paid on time and in accordance with any applicable labor laws.

d. Filing and Paying Payroll Taxes

Employers are responsible for filing payroll taxes with the appropriate government agencies regularly. This includes submitting forms and making tax payments for federal and state income taxes, Social Security and Medicare taxes, and any other applicable taxes. Failure to file or pay payroll taxes on time can result in penalties and interest charges.

2. Payroll Options for Small Businesses

There are several options available to small business owners when it comes to managing payroll. Each option has its own advantages and disadvantages, and the best choice will depend on factors such as the size of your business, your level of expertise in payroll management, and your budget. Some common payroll options include:

a. Do-It-Yourself (DIY) Payroll Software

DIY payroll software allows small business owners to manage their payroll without the need for external assistance. These software programs typically include features such as automatic tax calculations, payroll reporting, and direct deposit capabilities. While DIY payroll software can be more cost-effective than outsourcing payroll, it requires a significant investment of time and effort to ensure accuracy and compliance with labor laws.

b. Hiring an Accountant or Bookkeeper

Some small business owners choose to hire an accountant or bookkeeper to handle their payroll needs. This option provides professional expertise and ensures that payroll is managed accurately and in compliance with all applicable laws. However, hiring an accountant or bookkeeper can be more expensive than using DIY software or online payroll services.

c. Online Payroll Services

Online payroll services offer a convenient and cost-effective solution for small businesses looking to outsource their payroll management. These services typically provide automated tax calculations, direct deposit capabilities, and other essential payroll features. Many online payroll services also offer integration with accounting software, making it easier to track payroll expenses and generate financial reports.

3. Choosing the Best Payroll Service for Your Small Business

When selecting a payroll service for your small business, it's important to consider several factors to ensure that you choose the best option for your needs. Some key factors to consider include:

a. Cost

The cost of payroll services can vary widely, depending on the provider and the features offered. It's essential to carefully compare the costs of various payroll options and consider the value that each service provides in terms of time savings, accuracy, and compliance with labor laws.

b. Ease of Use

Payroll management can be complex, so it's crucial to choose a service that is user-friendly and easy to navigate. Look for software or services with intuitive interfaces and clear instructions to ensure that you can efficiently manage your payroll without unnecessary frustration.

c. Customer Support

When dealing with payroll, it's crucial to have access to knowledgeable customer support. Choose a payroll service that offers responsive and helpful customer support via phone, email, or live chat to ensure that you can quickly resolve any issues or questions that may arise.

d. Integrations

Integration with other business tools such as accounting software, time tracking systems, and human resources management systems can help streamline your payroll process and reduce the potential for errors. Look for payroll services that offer seamless integration with the tools you're already using to manage your small business.

4. Tips for Successful Payroll Management

To ensure smooth and efficient payroll management for your small business, follow these tips:

a. Stay Organized

Maintaining accurate records and staying organized is essential for successful payroll management. Keep track of employee hours, pay rates, tax information, and other relevant data in a well-organized system to ensure that you can easily access this information when needed.

b. Stay Informed

Labor laws and tax regulations are constantly changing, so it's essential to stay informed about any updates that may affect your payroll process. Subscribe to newsletters, attend webinars, or consult with a professional to ensure that you're up-to-date on the latest payroll-related information.

c. Communicate with Employees

Open and transparent communication with employees is vital when it comes to payroll management. Ensure that your employees understand your payroll process, pay schedule, and any applicable deductions to avoid confusion or miscommunication.

d. Regularly Review Your Payroll Process

Regularly reviewing your payroll process can help identify any inefficiencies or areas for improvement. Make adjustments as necessary to ensure that your payroll management remains accurate, efficient, and compliant with all applicable laws.

By following these guidelines and carefully considering your options, you can successfully manage payroll for your small business and ensure that your employees are paid accurately and on time. With the right payroll service in place, you can focus on growing your business and achieving success.

For any question, please contact us in OpenTimeClock.com. https://www.opentimeclock.com

Sources:

- https://clockify.me/blog/tracking-time/how-to-manage-payroll-for-small-business/

- https://www.businessnewsdaily.com/7477-choosing-payroll-service.html

- https://www.sba.gov/business-guide/manage-your-business/payroll-taxes

Video Script:

A Comprehensive Guide to Payroll Management for Small Businesses

Hello everyone,

Today, I want to talk to you about payroll management and how it can help your business. Managing payroll can be a complex and time-consuming process, but it's essential to ensure that your employees are paid accurately and on time.

To help with this process, I want to share with you a comprehensive guide to payroll management. This guide covers everything you need to know about managing payroll, including calculating wages, deducting taxes and benefits, and ensuring compliance with labor laws.

One of the most important aspects of payroll management is accuracy. Even a small mistake in calculating wages or withholding taxes can lead to serious legal and financial consequences. That's why it's important to have a solid understanding of payroll regulations and to stay up-to-date with any changes.

Another key aspect of payroll management is efficiency. By streamlining your payroll process, you can save time and reduce the risk of errors. This can be achieved by using automated payroll software or outsourcing your payroll to a third-party provider.

It's also important to ensure that your employees understand their pay stubs and have access to their payroll information. This can help prevent misunderstandings and improve employee satisfaction.

In conclusion, payroll management is an essential aspect of running a successful business. By following the comprehensive guide to payroll management, you can ensure that your payroll process is accurate, efficient, and compliant with labor laws. Thank you for listening, and I hope this guide can help you improve your payroll management practices.

For any question, please contact us in OpenTimeClock.com.

Created with the Personal Edition of HelpNDoc: Experience the Power and Ease of Use of a Help Authoring Tool