The 20 Best Payment Apps To Help You Stay On Top Of Your Finances

The 20 Best Payment Apps To Help You Stay On Top Of Your Finances

1. Introduction

When it comes to managing your finances, there are a lot of different options available to you. With so many different payment apps on the market, it can be hard to know which one is right for you. That’s why we’ve compiled a list of the 20 best payment apps to help you stay on top of your finances.

From apps that help you budget your money to those that allow you to send money to friends and family, there’s a payment app for everyone. And with so many different features to choose from, you’re sure to find one that fits your needs.

So, whether you’re looking for an app to help you save money or one that will let you send money to your loved ones, we’ve got you covered. Check out our list of the 20 best payment apps below.

https://unsplash.com/@sarahagnewcouk

2. What are the best payment apps?

When searching for the best payment apps, be sure to look for ones with features that will work best for your needs. Some of the best payment apps have a wide range of features, such as the ability to send money to others, create detailed budgets, and even track investments.

Here are some of the features you should look for when choosing the best payment app for you:

- Ability to send money to others quickly and securely.

- Multiple payment methods.

- Ability to create and manage budgets.

- Track investments.

- Manage accounts.

- Receive notifications when bills are due.

- Link multiple accounts.

- Security and encryption measures to protect against fraud.

The best payment apps should have these features and more to help you stay on top of your finances.

https://unsplash.com/@sarahagnewcouk

3. How do these apps work?

The best payment apps typically work in a few simple steps. After downloading and setting up the app, you will be ready to start using it. Most apps require you to link your bank accounts, credit or debit cards, or other payment sources. That way, all of your financial information is accessible in one place.

Once all your accounts have been connected, you can quickly and easily send and receive payments, create budgets and track investments, set up payment reminders, and more. Depending on the app, you may also be able to view your credit score, set up alerts and reminders, and manage multiple accounts.

Overall, these payment apps enable you to do more with your money, stay on top of your finances, and feel more in control of the money you manage.

https://unsplash.com/de/@claybanks

4. What are the benefits of using a payment app?

The top benefits of using a payment app include:

1. Increased Security – Payment apps are a safer alternative to cash and more secure than using a debit or credit card as they use encryption technology to securely store personal and bank details.

2. Convenience – Payment apps allow you to send and receive money quickly and conveniently from anywhere.

3. Money Management – Payment apps enable you to better manage your finances. They include features such as budgeting tools, investment tracking, and payment reminders.

4. Accessibility – Many payment apps offer users access to their credit score, financial reports, and other important reports that can help them better manage their money.

Overall, payment apps make it easier to manage your finances, while providing more security.

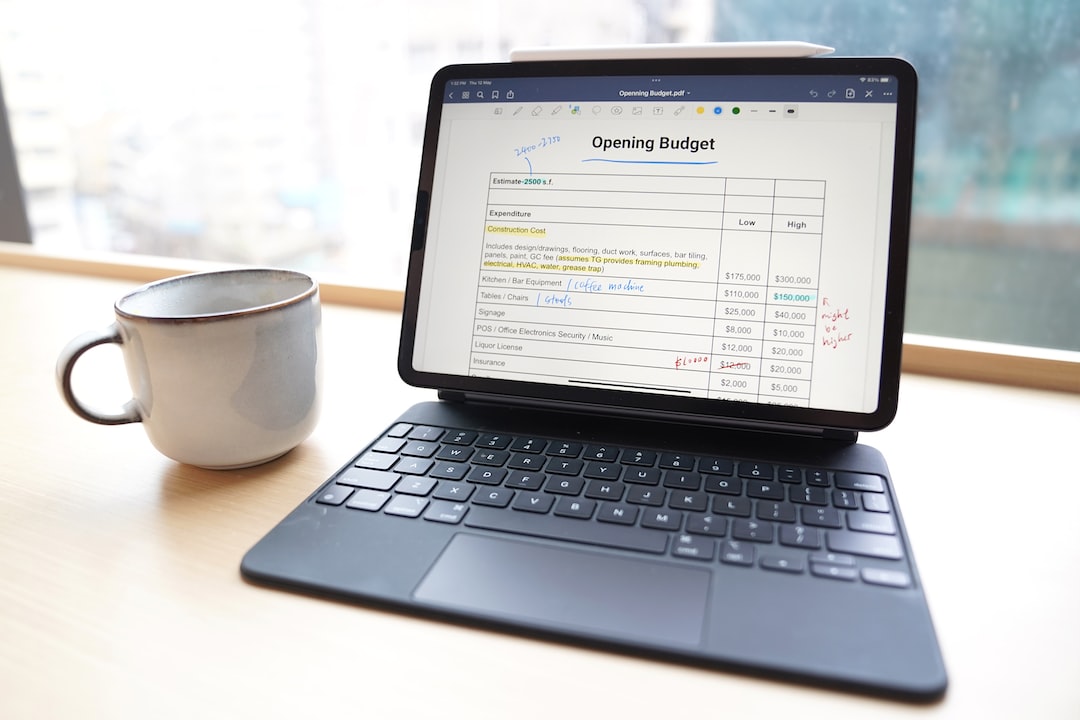

https://unsplash.com/@goodnotes

5. Which app is right for you?

It can be difficult to decide which payment app is the best one for your needs. Here are a few questions to help you find the payment app that's best for you:

1. What type of transactions do you need? Are you looking to make payments and send money to friends, pay bills, or save money?

2. What type of security features is the app offering? Security is a top priority when selecting a payment app. Look for features such as two-factor authentication, biometric authentication, encryption, and fraud protection.

3. What types of payments are accepted? Some payment apps offer only credit/debit card payments, while others offer both credit/debit cards and other payment methods such as PayPal, Apple Pay, and Google Pay.

4. Is there a fee associated with using the app? Most payment apps are free to use, but some may charge a fee for certain transactions. Make sure you understand any fees associated with the payment app before you sign up.

5. Does the app offer other features such as budgeting tools, investment tracking, and reminders? Consider the other features the app offers to see if it meets your needs.

By taking the time to answer these questions, you can ensure you're choosing the best payment app for your needs.

https://unsplash.com/@sincerelymedia

6. How to make the most of your payment app

Once you've chosen the right payment app for you, there are several tips you can use to get the most out of the app.

1. Set up budgeting and savings goals. Most payment apps offer the ability to track expenses and savings goals. Take advantage of this feature to keep track of your spending and reach your savings goals.

2. Schedule payments in advance. Many payment apps allow you to set up automatic payments for bills due on a certain date. This helps ensure your bills are always paid on time.

3. Make use of loyalty programs/discounts. Some payment apps may offer loyalty programs or discounts for using their services. Take advantage of these programs and discounts to save money.

4. Take advantage of purchase tracking and transaction history. Payment apps typically maintain an electronic record of all your transactions, making it easy to track your spending and view your payment history.

5. Utilize payment reminders. Most payment apps offer payment reminders so you can stay on top of payments and bills due.

Take the time to explore the features of your payment app and make the most of them. This will help you stay on top of your finances and reach your savings goals.

https://unsplash.com/@goodnotes

7. To wrap things up

Now that you know about the best payment apps and how you can take advantage of each one, let us wrap things up. As you have seen, there are a lot of payment apps available and each of them offers different features. From budgeting and savings goals to loyalty programs and discounts, payment apps can help you stay on top of your expenses and reach your savings goals.

It is important to do your research before choosing a payment app in order to ensure you find the one that is the best fit for you. Once you have chosen the right app, take the time to explore and make use of all the features it offers. This way, you can make the most of the app and gain complete control of your finances.

For any question, please contact us in OpenTimeClock.com. https://www.opentimeclock.com.

Created with the Personal Edition of HelpNDoc: Converting Word Docs to eBooks Made Easy with HelpNDoc